we're not the red cross

market vibes

February 2…)

“What I do for you, I do to you.” Comex pit broker’s adage

In the news, the shutdown started yesterday. The Epstein files are a house on fire. Minnesota is still a shit pit. The Eccles probe grinds along. The facts about the 2020 election are morphing from embers to flames. Trump and Iran are “talking.” On X… there’s serious tonnage of coverage on silver. For example:

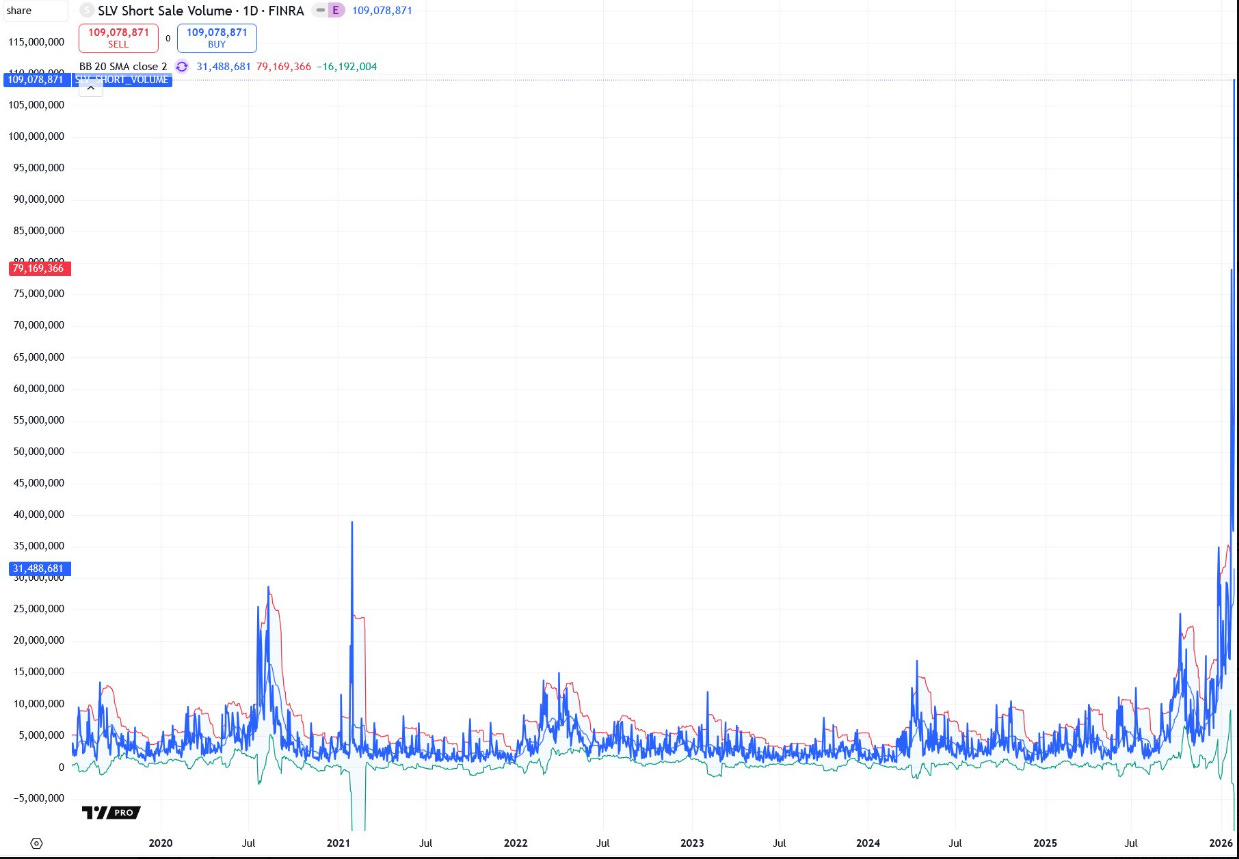

“SLV Short Sales Volume just went to heaven. There is no other way to describe the volume of short selling activity on January 30, 2026. Via Bob Coleman on X (good follow).” I asked Grok about it and apparently it was Reg SHO compliant with 5 days to borrow the shares.

In the markets

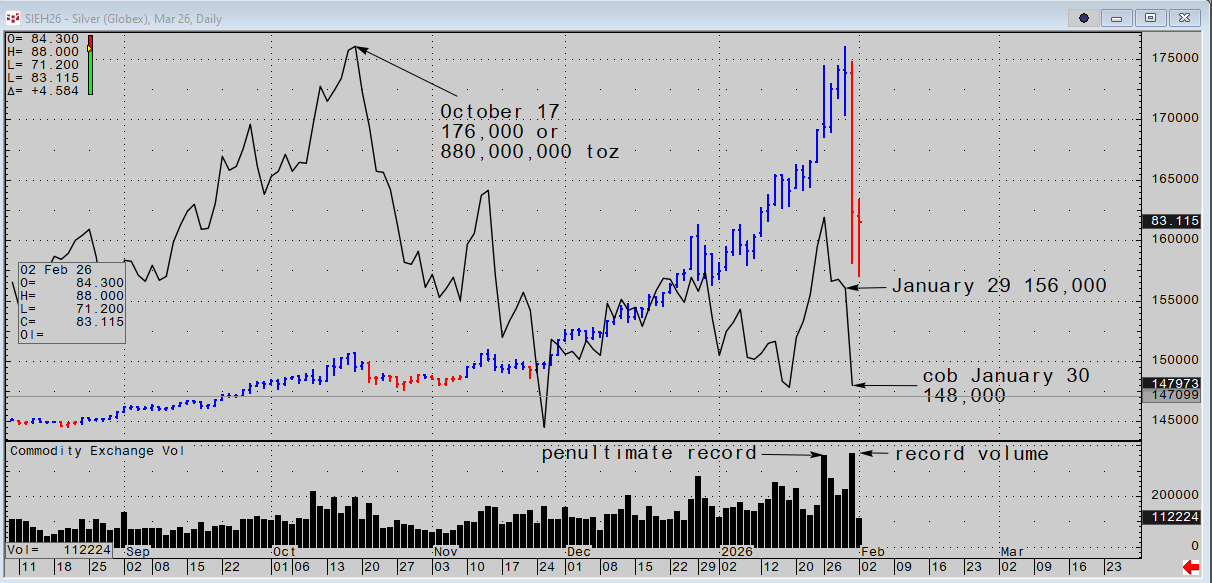

Open interest in silver fell about 8K lots on record all-time volume of 369,000 lots on Friday. I would liken this to a starving billionaire paying 5 million dollars for an anorexic boiled chicken and getting some bones and gelatinous skin with a glass of tap water to sate his appetite. Ranges are still off the charts. It’s likely the sellers have been aggressively buying. If true, the shortage of futures is going to be even more acute than ever.

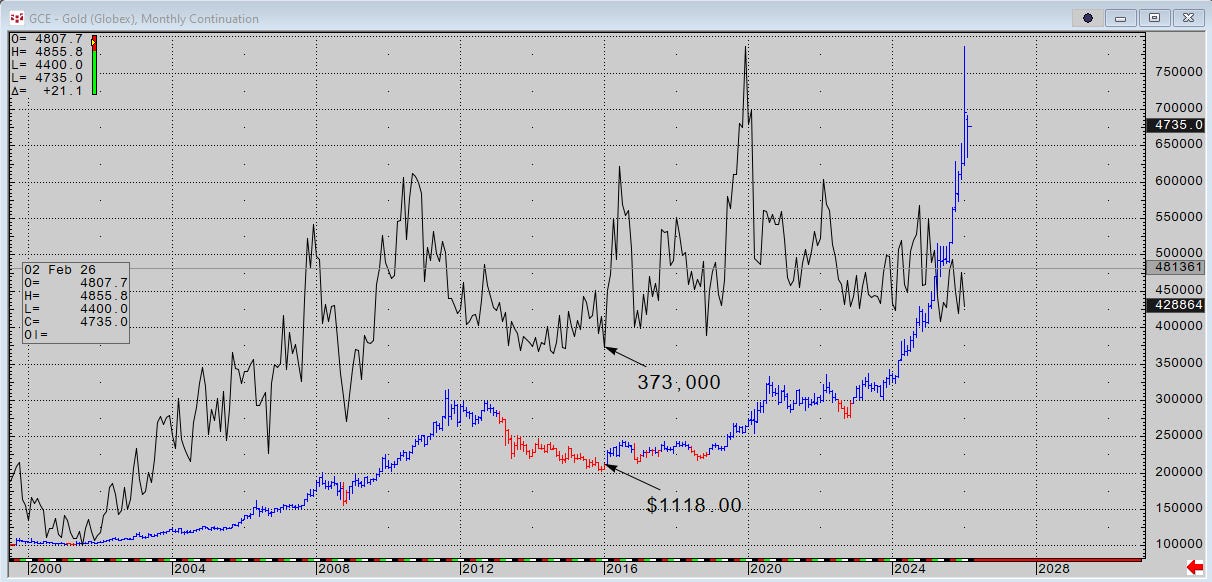

In gold open interest fell 70K lots on 3 million lots of volume last week, the highest weekly volume since March 2020. The item of note was a 22K lot delivery on Friday first notice day. It’s touted as enormous but really it’s only 2 million. Maybe as much as 50K lots (5 million toz) were sold on margin calls and panicky risk management. Compared to the range and the volume, its a drip from an eyedropper.

In monthly data, COMEX gold open interest is approaching its January 2016 lows when prices were around $1000 per oz. It’s hard to make a market go down when there’s so little for sale… and if China keeps buying… there’s so very little for sale.

Bitcoin is bouncing after holding the Michael Saylor average entry of $74K. That’s actually a red-line number, I think. If that goes, something bad is afoot. Technically, no indication of a bottom.

The BTC head-and-shoulders formation is developing normally. The neckline is at $105K. My guess is whether or not Saylor survives… from whatever level this bear bottoms out… we’ll test the neckline before bitcoin either goes to the junk pile or finds its lost mojo. There is too much horsepower committed to bitcoin to just let it die. If powerful forces in the markets can put silver down 40% in a single session, they can try to save bitcoin.

Oil is down $3.00 because Trump says Iran is “seriously talking.” Flat prices are much weaker than the Q2 curve. It’s just another example of his “peace in the Middle East” strategy.

S&Ps were down 20. Now they’re up 30. The dollar is a little higher. I like copper so I don’t look at it every day wondering what I think.

my vibe

Life is not fair and markets are like life. The powerful predators eat the baby goats. Sprott still runs a respectable ETF and there are many honest dealers who refine and sell physical gold and silver. A little due diligence is a good thing, in my humble opinion. It’s not up to the T-Rexes to be fair. They obey the laws as they are written (because they influence the process). As my boss used to say, “We are not the Red Cross.”

I was a member of the COMEX for most of my working career (1977 to 2014) and I can say hand-on-Bible you don’t need permission to be honest. When the members owned the exchanges some guys played it straight, others not so much… but on days like last Friday, it was just another kind of bad.

If you want to play, you have to pay…It’s on you to do what you have to do before it’s done to you. In the most useful two words from a guy named Scott Duffy, rest his soul in peace, “Keep moving.” (Hat Tip KW)

JJ

If you like reading market vibes please hit the like button, and type in your e mail below to become a free or paid-up subscriber. Thank you.

Share selectively with friends and colleagues and follow me on X @Alyosha745

Charts and data CQG and Bloomberg

Market vibes is not a registered investment advisor. Comments, thoughts and opinions are entirely those of the author without any representations to accuracy and are for informational use only. Any mention of a particular security, index, derivative, or other instrument is NOT a recommendation to buy, sell, or hold that security, index, derivative, or any other related instrument.

The villain fox that kills ducklings is the hero fox that feeds its kits. No right or wrong in (the rest of) nature - just consequences. I was top-heavy silver, bought more Friday, more this morning. My version of Belichick "just getting ready for Cincinatti" is "5 year strategy, 5 year tactics" (my panic-managing mantra).

Wisdom is garnered from often-painful experiences studied, sifted out from emotion and articulated.

Thanks again for your wisdom!

Yeah this whole engineered smash makes me angry. It was very controlled and constant so as not to trigger halts in trade for hours on end. I guess. China will start mopping up the floor with prices lower.

The day of reconning when the physical smashes paper is coming. They just delayed it a bit so some fat cats could get out from under their short positions. (Probably on the too big to fail list)

Why put silver on the critical mineral list for the USA then smash the price and send even more to the far East?