June 13…)

“There is violence in the air, people. So much of it we have trouble keeping track of it.” Alyosha June 11

U Mich at 10;00 AM EDT. As usual the datum to watch is 1 year inflation expectations, nearly 3 times higher than the BLS CPI and PPI reported this week. The target audience and representative sample is 500 US households. Survey Question: “By what percent do you expect prices to go up, on the average, during the next 12 months?”

In the markets

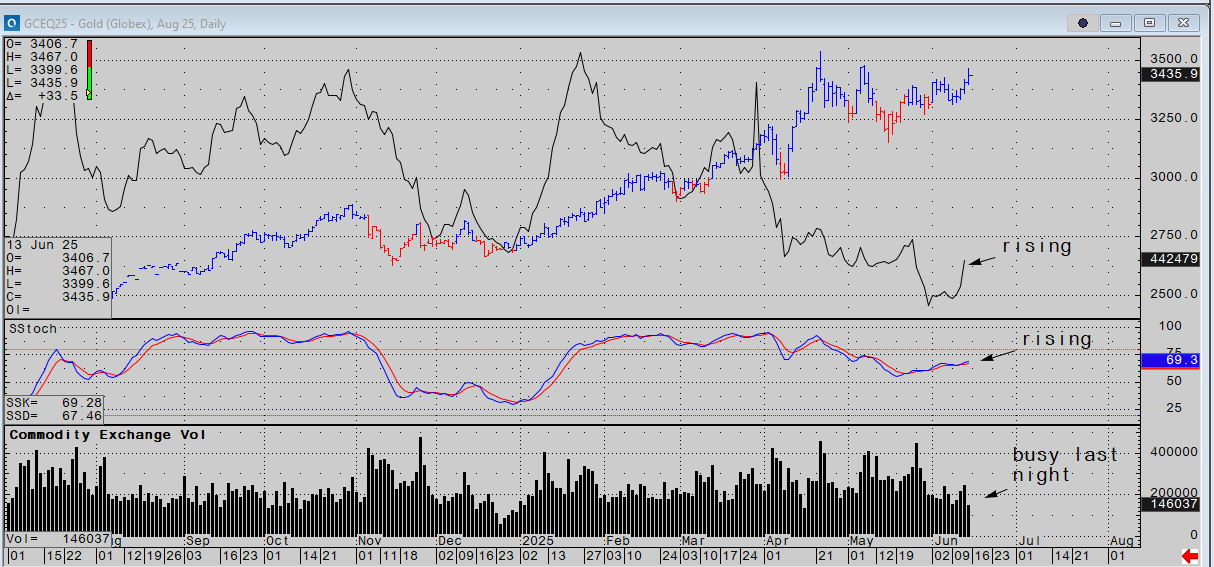

Gold had a respectable rally on the news last night, certainly no sense of panic. Since the early '80s, whenever military activity of any magnitude was planned, financial leaders were informed to add whatever liquidity is needed to deprive the opposition of a weaponized effect in gold or stocks.

If I didn’t actually see it on TV, I wouldn’t be overly excited about gold this morning. In might be trading the top of the range from the short side.

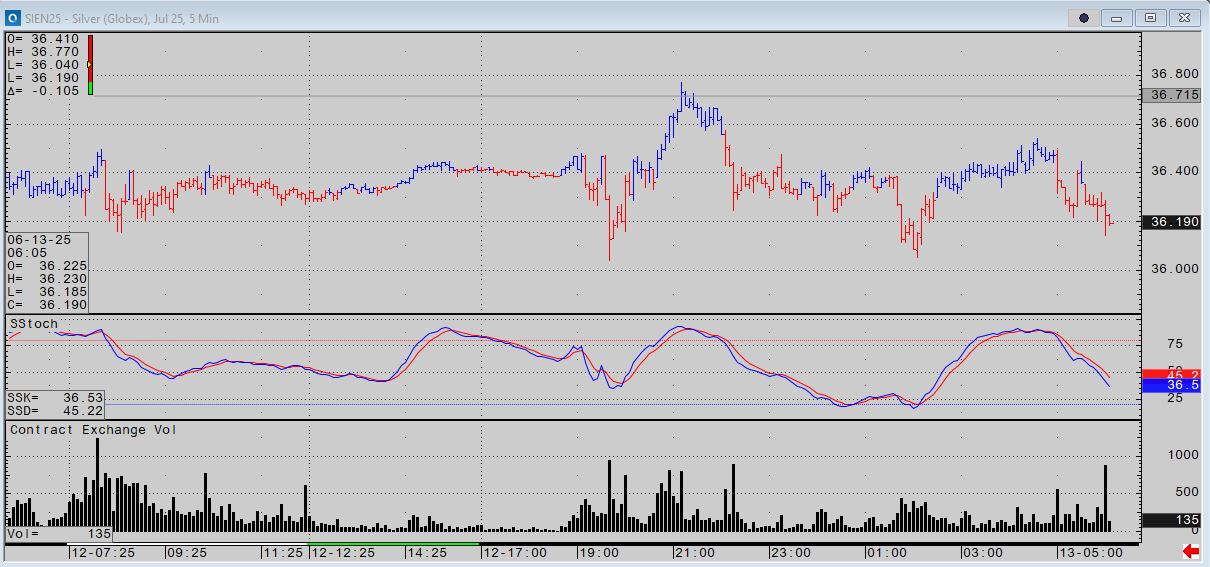

In hourly data, silver was obviously reluctant to react with higher prices, and there were several hard down sweeps during the night.

If precious metals are going to trade vertically higher, it will not be during a time of intense military activity, imo. That has been a rule for 40 years. I will say, in the past, gold and silver went sharply lower, and this time there is a clear and persistent demand that keeps coming back. We’ll see how the day develops.

In hourly data, S&Ps were predictably well defended. The buyers of US equities have been consistently dedicated to a regular program of acquisition for weeks, disregarding any and all negative news and data releases.

This dip may have attracted weak short selling, and open interest has been so low for so long there may not be a lot of length at risk unless prices go much lower and much faster. I think the stock market cares more about the FOMC than Iran. Is that foolish? It certainly could be.

Anything can happen to oil now. There is no shortage of it, but depending on the geopolitics, which are debatable and murky, the world might be able to adjust very quickly to the loss of Iranian oil.

High prices tend to solve all shortages better than any other remedy, and today we have the technology, market liquidity, and capital to act spontaneously. In fact, I would guess the other OPEC producers will be quick to dine on Iran’s market share ASAP. I would also think they have been preparing for it.

At any rate there are no safe entries in oil futures unless you are an oil producer.

In other markets, the dollar is higher as the haven returns, bonds are lower as money runs to the short end, and bitcoin is down with stocks.

my vibe

It would be foolish to think these riots going national and the deliberate Iranian provocations since Wednesday are unrelated. Iran (and its allies) wanted this war to begin last night, in my opinion. Iran is ready. It would be foolish to think the Iranians are not already here in America among the “protesters”, probably hundreds if not thousands of them. So, trust no one, especially the press..

As millions poured into America, the most common observation was that the majority of illegals were military-aged men. “Where are the women and children?” There are hundreds of organizations like Antifa and BLM now, all funded with NGO taxpayer billions, the Waltons, Soros, and others. The cartels are here. Caches of weapons similar to those sent to Ukraine are stowed on the other side of the southern border.

In Florida, the governor has told people it’s OK to run down car mobbers. Police chiefs have issued public warnings they plan to load live ammo and use it. Let that sink in.

Last night, as most citizens were watching the Israeli shock and awe attacks, protesting and riots were underway in cities across the nation. Grok listed 13 cities in 7 states from Atlanta to Arizona and several locations in California. Mayor Brandon in Chicago said in a fiery speech: “This is what it would look like if the Confederate South had won! This is a civil war.”

No one ever thinks the worst can happen because they don’t know what the worst looks like until it happens to them. Always hope for the best but always plan for the worst. Even if you can’t grasp its implications before it’s too late, a little forethough and prep is better than none…

If you’ve ever been in a car accident you know it’s that quick when it happens.

Trump is still trying to make a deal.

Be careful out there

JJ

If you like reading market vibes please hit the like button, and type in your e mail below to become a subscriber.

Share selectively with friends and colleagues and follow me on X @Alyosha745

Charts and data CQG and Bloomberg

Market vibes is not a registered investment advisor, and comments are for informational use only. Any mention of a particular security, index, derivative, or other instrument is NOT a recommendation to buy, sell, or hold that security, index, derivative, or any other instrument. Market vibes makes no representations as to the accuracy of data or any attributions.

We all need a break from the “mayhem” 4 th turning, enjoy Father’s Day this weekend, burn something on the grill and watch some great hockey…

Looking at the futures it's interesting to see bonds ticking down against a stronger $ and weaker equities. With crypto down across the board it looks like gold is the only safe haven.