December 1… )

"The man is the head of the family; the woman is the neck that turns the head." Anonymous origin, common in the Balkans.

I was entertaining ICBC’s gold desk at the Savoy Hotel in 2013 before going to see “Matilda the Musical” as a group of ten. My wife attended and in a jocular moment, they had a good laugh with this aphorism while schooling me on marriage in China.

In the news this weekend:

Last Friday, I posed the question, “Where is Trump?” a rhetorical “Where’s Waldo”, so to speak. Well, Mar a Lago is the answer and this weekend the President Elect met with the Prime Minister of Canada: "We discussed many important topics that will require both countries to work together to address, like the fentanyl and drug crisis that has decimated so many lives as a result of illegal immigration, fair trade deals that do not jeopardize American workers, and the massive trade deficit the U.S. has with Canada." The 800-pound gorilla is the $130 + billion imbalance due to imports of Canadian oil which we need. The other stuff is a modest $40 to $70 billion in services and goods since covid, according to the US Census Bureau.

Later in the day Trump posted this: “The idea that the BRICS countries are trying to move away from the dollar while we stand by and watch is OVER. We require a commitment from these countries that they will neither create a new BRICS Currency, nor back any other currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy.”

Finally, as this latest deep dive into gold gets underway the Fasten Seat Belts light has been turned on: “China could allow its yuan to depreciate by as much as 10-15% in response to any trade war unleashed by Trump.” JPM opined via Bloomberg. “The bank sees a 5% average depreciation in emerging-market currencies.” This would be bullish for gold, I think.

In daily data, Gold has been liquidating open interest at a beakneck pace since October 29; a Tuesday in the quiet period preceding the election. During the wee hours of November 6 as stocks and dollars exploded higher, gold began an all day sell-off ending $95 dollars lower. My sense at the time was Trump’s win meant nothing to gold, not bullish, not bearish and a strong dollar was more than enough to knock it over.

Buying in USD FX was relentless and length in gold with bad location sold into a void. Selling begot selling… $260 dollars lower and 7 sessions later responsive buying finally entered the market. Open interest has been falling apace because December gold options expired on Novemebr 25 and the last of the Decemeber rolls were done on first notice day November 29. The gold market is sold out.

Every vertical decline in Comex gold open interest since November 2022 has been followed by a tradable rally, sometimes a very good one.

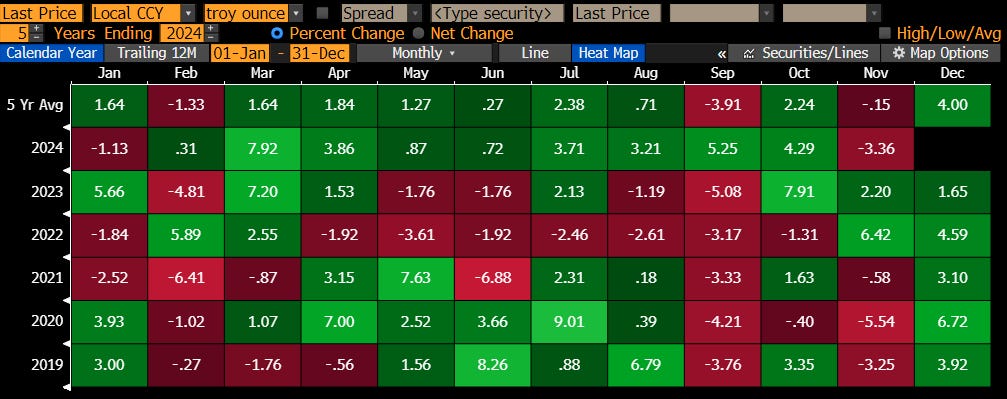

This technical setup favors longs with good location in December, not the least of which is past trends in seasonality (BBG chart below). So, let’s get right into it and find out why.

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.