December 17 … )

“Every age has its peculiar folly: Some scheme, project, or fantasy into which it plunges, spurred on by the love of gain, the necessity of excitement, or the force of imitation.” Charles Mackay 1841

In the news

Bloomberg penned an editorail titled: “Bitcoin Reserve Could Be the Biggest Crypto Scam Yet.” They cite all the humdrum negatives; [it] does nothing, earns nothing, serves no monetary purpose, has connection to the economy, credit or commerce, and they question the thesis it could ultimately … some day… be used to pay off debt. Everyone knows this chapter and verse but the punch bowl is full.

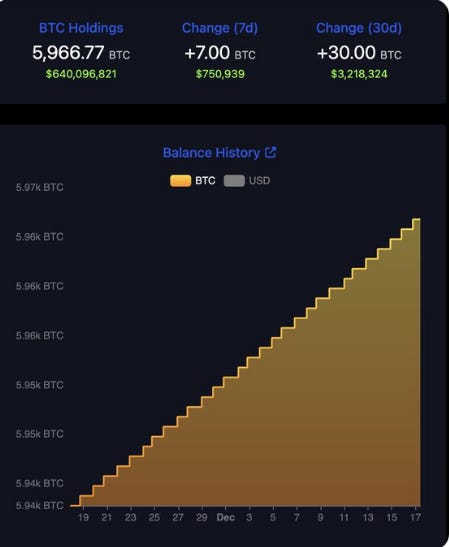

Sarah Knafo Member of the European Parliament was speaking in favor of an official EU bitcoin reserve today On X a post noted El Salvador started the policy of buying 1 Bitcoin every day on November 17, 2022 and hence has accumulated nearly 6000 bitcoins (the graphic below). Here is RFK Jr on bitcoin, July 2024. And of course Trump is a fan.

In the Markets

December bitcoin made another new high on the CME this morning. Volume, open interest, and prices are rising together. In my opinion, the best expression of a trend is a gradual move up, allowing new longs to be established at higher prices while sentiment adjusts without frantic spikes and voids in liquidity, which typically cause choppy backfilling and anxiety. So far, bitcoin has remained calm at $100K, dispelling the punditry of acriphobic bears.

However, sooner or later, the political side of the debate will have to address the obvious one-sided enrichment of speculators as national treasuries acquire millions of coins with taxpayer dollars.

More on this in a minute as we look at bonds and gold, two obvious losers in this latest iteration of Charles Mackay’s manias.

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.