December 20...

The bears are planning their day...

In the news

Trump wants to end the debt ceiling, a generally popular idea since we’re already pushing $37 trillion. Dems voted against it, along with 35 Republicans. Trump is threatening everyone with tariffs, according to "Little Mike's" daily Trump hate. Mary Daly of the SF Fed says she sees a path to both lower inflation and strong jobs and growth. “We’re really working toward that soft landing.” I suppose that doesn’t include the stock market. In other nonsense, WMT is trying to sneak out the ESG door with everyone else complaining it’s too expensive. Believe it or not, coal may make... a comeback.

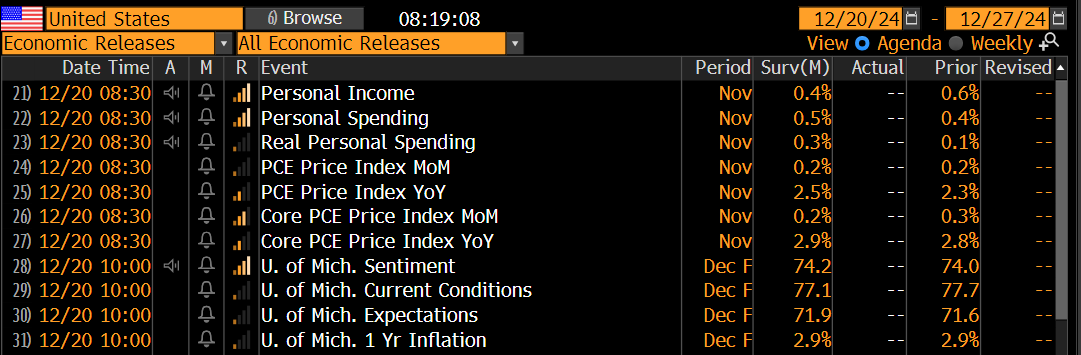

Data at 8:30

In the markets overnight

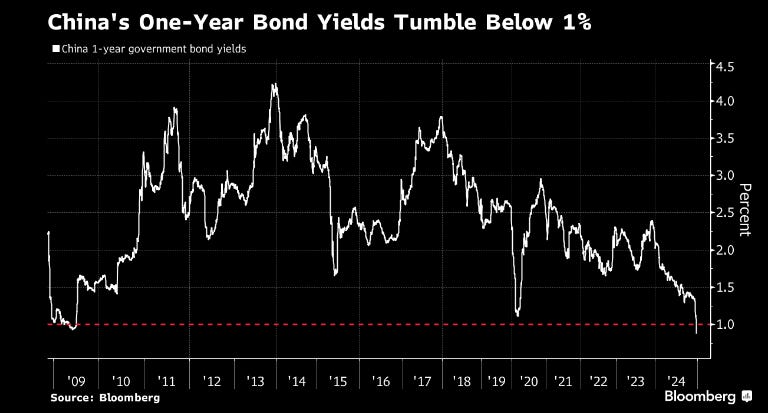

The yield on one-year Chinese government debt fell 17 basis points to 0.85%, the lowest since 2003. In percentage terms, the move is 3X the FOMC’s 0.25% cut on Wednesday.

China’s 10-year printed 1.718, a new all-time low. CNH printed 7.3269 yesterday, a new all-time high. If this keeps up, it’s hard to imagine commodities staying down, especially gold and silver, but the charts don’t confirm that idea this morning.

Here is the BCOM with DXY overlaid. I see a correlation to the 2021 post-COVID restart. Then, of course, the FOMC had to get involved. The point is that vaccines, good or bad, gave us a reason to bust out of the basements and make some money. Trump’s election seems to have been a similar magnitude of force.

At any rate, it’s a big expiration for stocks, and they’re moving this time. Let’s get started on metals, bitcoin, beans, gasoline and stocks.

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.