July 10…)

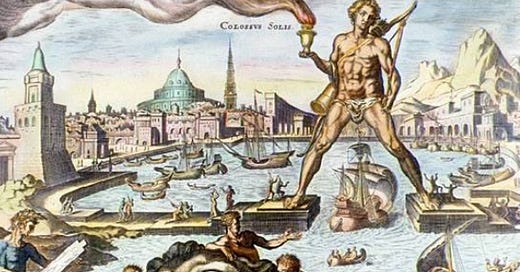

"Keep, ancient lands, your storied pomp!" cries she with silent lips. "Give me your silver, your gold, your copper yearning to breathe free!” Emma Lazarus

Jobless claims at 8:30, 30 year Bond auction at 1:00 PM EDT

In the news

Three weeks to get copper over the US border and snag a juicy LME-Comex arb. Apparently, Hawaii and Puerto Rico are top destinations. Here we go again!

In politics and trade, it is regime change by any other name. Trump’s 50% levy on Brazil is unabashedly political, citing political interference in the Bolsonaro trial. As tariffs evolve, they are beginning to look a lot like sanctions.

OPEC banned 5 major news agencies, including Reuters and Bloomberg, from covering their meeting in Vienna today and tomorrow. No specific reason is given, but ABS has intimated a distaste for their coverage many times. Trump might call it fake news. Personally, I agree.

The narrative going into the meeting is higher OPEC production is necessary for OPEC to reassert control of the market: “[The fact] that the market hasn't seen an increase in inventories despite prior supply expansions was proof that more barrels were needed.” API and the DOE reported a 7 mm bbl build yesterday.

In the AI world, NVidia did touch $4T yesterday. Elon Musk's AI startup, xAI, is rolling out Grok 4. Yaccarino resigned yesterday as META paid 200 million to poach an Apple engineer. The bubble is walking and quacking like a duck, so it probably is one.

In the markets

Comex copper is unchanged, and LME copper is +70, so the arb is narrowing. The rub in copper is you can’t book it on air freight, and it’s about 20 days from Shanghai to Hawaii. Lol. Willie makit? Betty don’t. Very funny.

All work and no play makes DXY a very dull boy.

In gold and silver, SSDD.

Platinum has been relegated to lesser esteem in recent years, but it is a precious metal when it wants to be. If I were to pick two words to characterize it, I’d use “baited breath.” The deceration at the top implies a lot people ar not happy about this rally and hoping it will go away if they just leave it alone.

A market that clings to its highs implies unfilled buying below.

In oil, I don’t think the object of the meeting in Vienna is to hurt oil prices; it is to message the oil world they want their market share back after two years of subsidizing global prices. I would not be surprised if, over time, a lot of floating storage were lurking somewhere not far from LOOP. Say 20 VLCCs?

US rig counts are in steep decline. But that may be temporary. At any rate, it will not go unnoticed in Vienna. Meanwhile, Canada is planning to ramp. Norway is increasing. Putin’s war is expensive. The spice must flow.

The Aug/Sept/Oct fly is lower again. Watch the spreads.

In the stock market, there is a narrative that the BBB has not yet been fully discounted with higher prices for small caps meaning the DOW (small caps?).

Unfortunately, most flows are cap-weighted, and 43 cents of every dollar goes the Mag 7, 50% goes to the biggest ten stocks. NVidia at $4T means … “more for me, none for you.”

Even with such an incredible statutory privilege, it is SSDD every day in NDX futures.

Bitcoin tries the patience of Mr. Munger.

But not Cathie Wood. FWIW, she’s still bullish on Tesla, and ARKK (chart below) is up 75% from its April lows. The trouble with ETFs on equities and bitcoin that pay nothing is the cost of carry and years of lost opportunity.

my vibe

I have the smallest trading exposure in a long time. I agree with the guys in the game sitting on cash, getting paid for waiting. Fink toyed with the idea of offloading PE into his client accounts which is… just wow. I recall TBTF-ers recommending mezzanine tranches of CLOs to their besties in 2007.

No one knows how this Trump gambit plays out. One thing for sure, if it starts working, the stampede coming over the hill won’t be AI. It would be nice if Wall Street still had smart people in the crow’s nests, but they fired them and bought robots. And as they say, “birds of a feather flock together.”

I think when nothing is moving, I shouldn’t be either. Best of good fortune today if you are.

Jensen in 2009 …worthy

lol…what?

JJ

If you like reading market vibes please hit the like button, and type in your e mail below to become a subscriber.

Share selectively with friends and colleagues and follow me on X @Alyosha745

Charts and data CQG and Bloomberg

Market vibes is not a registered investment advisor, and comments are for informational use only. Any mention of a particular security, index, derivative, or other instrument is NOT a recommendation to buy, sell, or hold that security, index, derivative, or any other instrument. Market vibes makes no representations as to the accuracy of data or any attributions.

“Fink for toyed with the idea of offloading PE into his client accounts which is… just wow. “.

I saw the same thing last week and said…”Somebody just rang a bell.”

If Good Ole Larry wants to dump junk PE on to Joe Sixpack then the mark-to-market numbers must be toxic if not fatal.

Sanctions is 100% the right way to interpret / analogize the “reciprocal” tariffs. And China remains the end target. The other tariffs all connect back to forcing and / or providing cover to third parties to get them to raise barriers on China (or in Brazil’s case, with whom we have a trade surplus, as punishment for a number of things - Lula’s love of Xi among them).

TACO is perhaps the single worst consensus call since “Trump has zero chance of becoming president” imo. He started an economic war, not an economic policy. That war is raging on.

To that very end, I wrote the following in a post on April 24th and stand by it 100%:

“To understand this trade war, I believe, you simply have to recognize that “reciprocal tariffs” has little to do with rectifying all bilateral trade imbalances. It is forceful leverage to push every country on earth to choose sides in a Cold War - something they are universally loathe to do.

“…it’s important to consider that universality is a vital component of economic warfare. When you apply sanctions on a country blocking their access to banking services, it doesn’t work unless you block them from accessing any banking services whatsoever. These tariffs, in my view, are functioning as sanctions by another name.

“We aren’t just trying to shut off China’s manufacturing sector from the United States, we’re doing the best we can to block their ability to keep running those factories period. We’re trying to stunt their growth.”

https://open.substack.com/pub/harrisonlewis/p/the-clue-is-in-the-name?r=2ppeb1&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false