September 4…)

“It will be a nice day if it doesn’t rain.” Raphel Bostic earlier today

The Nikkei fell below the 200 D MA last night (9 PM Sept 3, EDT) and Taiwan fell 5%. I haven’t a clue what China’s CB is thinking but SHCOMP looks terrible. The Hang Seng looks boring but ok.

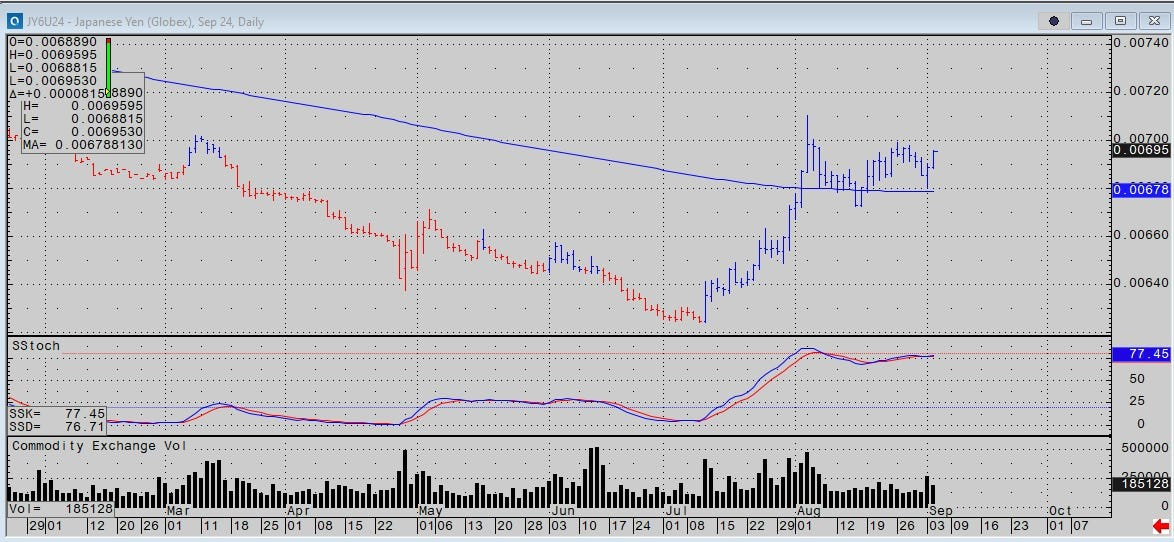

The Yen’s strength (CME futures chart below) and the Nikkei’s weakness implies the BOJ is inviting you to swap the carry trade for a pairs trade. We’ll see what happens tonight.

US stock indexes opened lower, rallied early with a lively flurry and fizzled on a dreary JOLTS report. Durable goods orders are up nearly 20% in 2 months. Either that’s a bad thing (higher rates) or the JOLTS report is a bad thing (lower rates) but they can’t both be the same thing. At any rate the rest of the data slate was benign, and the Fed seems indifferent to good news. Bostic said, “The labor market is weakening but it’s not weak.” Canada cut .25 as expected.

This is a weekly chart of NDX futures: a well-formed 1 bar down with % D trending lower. The oscillator is 45 weeks of data so not a lot of choppiness when it’s trending. Gradualism is good when it’s going your way.

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.