June 18…)

“The trouble with the rat race is that even if you win, you're still a rat.” Lily Tomlin

In the markets

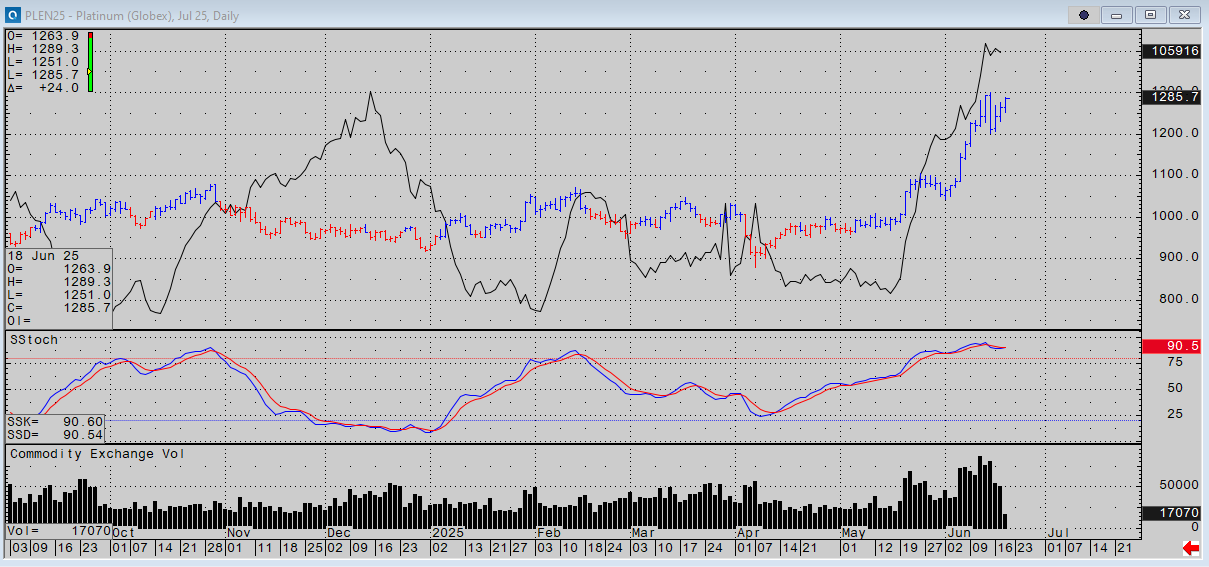

Platinum is notably higher again at the tippy top of its rally. OI has been flat for a few days, indicating the book is trading flat and no one is capitulating yet. Total NYMEX inventories continue to trend lower. Total XPT ETF holdings have been higher but erratic. No sign of failure in the rally.

In other metals, gold, silver, and copper are behaving like they did yesterday: copper in the middle of its multi-week range, gold a little soft, and silver holding very close to a 14-year high.

Spot DXY is so close to this T line, I think whatever the FOMC does or Powell says today, it will punch through just to explore what’s above it. The outcome will have a knock-on effect on metals. It could be a failed auction or the start of something.

Looking a little deeper into DXY the CME Sept euro is 58% of the index and near its highs on surging OI indicating a short dollar Fad. Even so DXY is higher this week and threatening the T line. I think Bessent would prefer a stronger USD.

The pound took a hit yesterday. CHF, Yen, and CAD futures are motionless.

September WTI is developing at the top of its recent range on declining volume and a slight uptick in open interest yesterday. ATM vols have dropped from the mid-70s to 68ish. The API reported a 10 mm draw yesterday. Gasoline and disty were -300k and +200k. Crude in a vertical rally with no signs of failure.

Spot RBOB cracks haven’t improved.

DOEs at 10:30 today. This is a worksheet with last week’s data for your guide. I’ll post an update on Notes when we get the report.

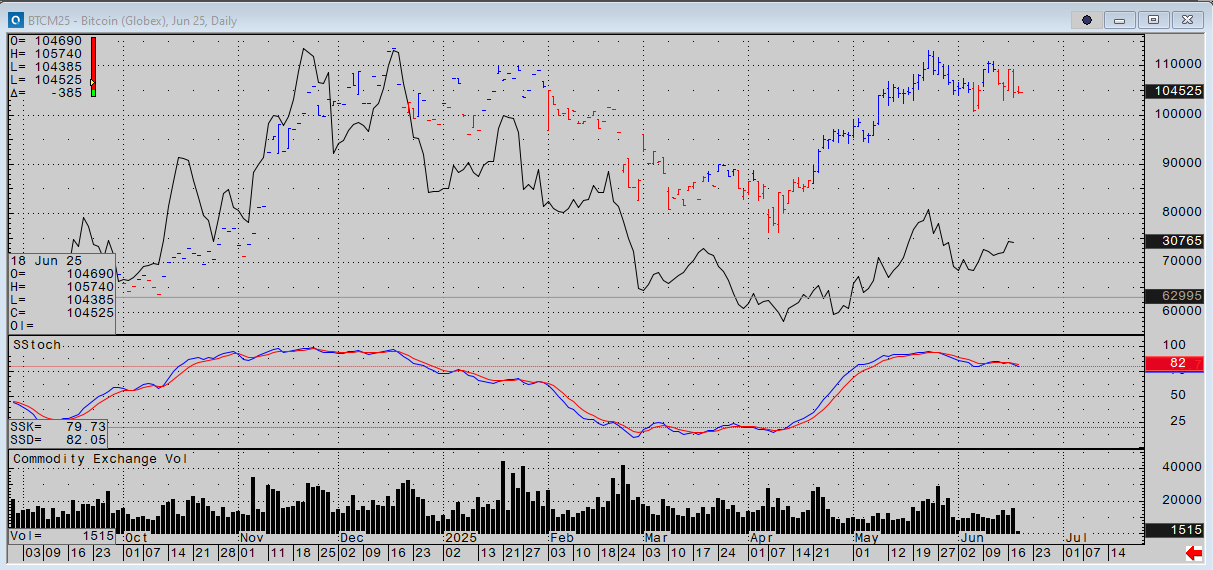

Bitcoin is not in the hunt, and I don’t think it will have a voice until the war in Iran is over. The most important dates on the calendar are the last week of June.

my vibe

According to a Grok search, there have been 8 Arab-Israeli wars since the State of Israel was created.

From 1917 (the Balfour Declaration) to Israel’s 1948 Independence Day, there were no significant military engagements between Israel and other regional states resolved by treaties. I noted the wars, exclusive of skirmishes and cross-border incursions, in which Israel has engaged:

1948 Arab-Israeli War - decisive victory

Suez Crisis (1956) - tactical victory

Six-Day War (1967) - triumphant victory

Yom Kippur War (1973) - military victory, strategic draw

1982 Lebanon War - mixed outcome, costly, not a win, not a loss, not a draw

2006 Lebanon War - stalemate

Israel-Hamas War - ongoing

Israel-Iran War - strategic extension of the Israel-Hamas War

Despite overwhelming thymotic urgency in the region, national sovereignty is, as ever it was, the key to peace. Regime change will start another oil war, another Ukraine, or worse, and turn the jackals loose.

This is the 2nd war per se Iran has fought since its coup d’état in 1979, the 1st being the Iran-Iraq War in 1980. It may not be the last if the hawks get their way. I mention this because Middle Eastern oil producers were on the cusp of losing their “war premium” per barrel and looking at $40 to $50 dollar oil on June 1st. Now the pundits are already discussing the “floor” for oil. This would radically change the forward curves for everything, especially inflation.

Plato uses the analogy of a chariot to illustrate three relationships defining our being: reason (logos) is the charioteer, guiding two horses: one representing desire (eros) and the other representing spirit (thymos). The charioteer's task is to maintain harmony and balance between these two horses, directing them towards virtue and a well-ordered life.

Let’s try this again… It should be a quiet day.

JJ

If you like reading market vibes please hit the like button, and type in your e mail below to become a subscriber.

Share selectively with friends and colleagues and follow me on X @Alyosha745

Charts and data CQG and Bloomberg

Market vibes is not a registered investment advisor, and comments are for informational use only. Any mention of a particular security, index, derivative, or other instrument is NOT a recommendation to buy, sell, or hold that security, index, derivative, or any other instrument. Market vibes makes no representations as to the accuracy of data or any attributions.

Thought you might enjoy this interview while watching your screens today:

Victor Davis Hanson Interviews David Mamet author of:

“The Disenlightenment

Politics, Horror, and Entertainment”

Mamet’s concept of the Open City and Hansen’s perspective on Trump vs. Iran

First 5 min is commercials

https://www.youtube.com/watch?v=dg2oEuBHcK4

JJ, another succinct analysis, thank you for your work product.

all the best

m