June 17…)

“Though wise men at their end know dark is right,

Because their words had forked no lightning they

Do not go gentle into that good night.” Dylan Thomas, 1951

Data this morning includes retail sales, tariff related metrics, and the general health of the economy. Yesterday Jamie Dimon said he expected this kind of data to decline.

In the news

Various confirmations continue from sources that Tehran wants to resume negotiations. “We never left the negotiating table,” they say via intermediaries and the WSJ. “We were attacked.”

On Friday, I said, “The challenge for the press will be to separate the oil narrative from the stock market.” That has taken the form of this echo across all media: “Oil is well supplied.” The line was repeated often yesterday. “Regime change” is the runner-up for conservative themes, followed by Israeli military prowess.

In Ukraine, Putin is pounding Kyiv, according to Bloomberg. Macron urged Trump to increase sanctions on Russia. Trump said, “Let them fight it out,” last week. I think, when he says to the Mullahs, “You should have taken the deal,” he’s saying the same thing to Iran. Or, better said, if you want a ceasefire… surrender. That is probably his message for Zelenskyy, too.

In finance, Ken Griffin opined in a BBG interview, “Novice investors can’t win,” foreshadowing the last chapter of Wall Street. Concurrently, a part of the President’s tax bill will gift $1,000 of seed money deposited into investment accounts for would-be novice traders born between January 1, 2025, and 2029.

Citadel and others, like BlackRock, will manage the funds and invest them in stock index funds. The deadly flaw in this plan is it’s simply a gift. To whom, one might ask?

Pockets of violence persist in blue-state cities: LA, Chicago, and Seattle. It’s likely this is going to be a fact of life for as long as ICE is actively deporting illegal migrants. There are a lot of unemployed migrants and disaffected poor in urban America, and $200 a day in cash is a job.

In the Markets

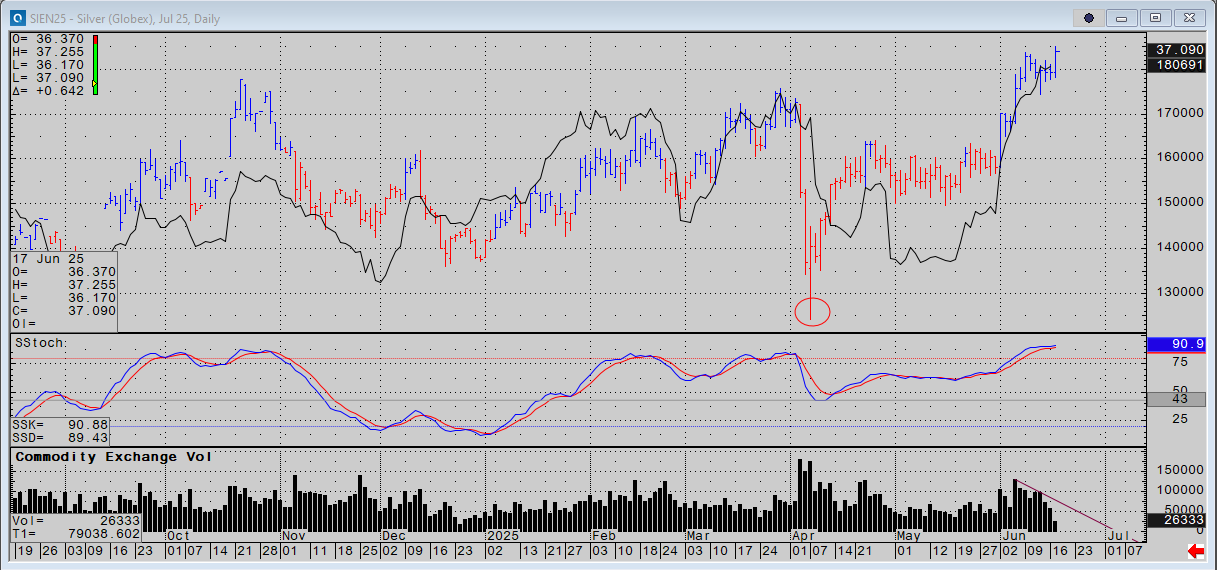

Silver is making a 13-year high this morning, just 29 cents from a 14-year high if $37.48 is breached. The chart in monthly data illustrates relatively low aggregate open interest in contrast to the highest net non-commercial long position in 6 years, based on last week’s COT reports. I have encircled the April 3 isolated lows, which completely flushed all weak length.

In daily data, OI is rising with price, but volume is notably low. I think growth in futures is gamma hedging and shorts managing risk. If it were a spec run, there would be news coverage, and there is utter silence in silver, both in exchange activity and the press. As I have said often, there is a sizable short SLV option position live and ITM at these levels, due to expire on Friday.

Dylan Thomas wrote so eloquently when drunk in his rooms at the Chelsea Hotel, “Do not go gentle into that good night.” I doubt the short sellers will go gently on Friday either. Kicking and screaming is more like it.

Onward we go tis morning… with gold in a chill mood, stocks over supplied, oil in the middle of the rally in time if not price, and bitcoin facing another roll before quarter and H-1 end. Plus some ideas on imminent peace in the vibe.

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.