"The spice must flow," the Emperor's CHOAM Director said, his voice nasal and precise. "The Imperium's economy depends on it. Every noble house, every corporation, every world hungers for melange. Without it, navigators cannot see the paths of safe travel, and the great houses cannot maintain their power." Frank Herbert, Dune, 1965

In the news

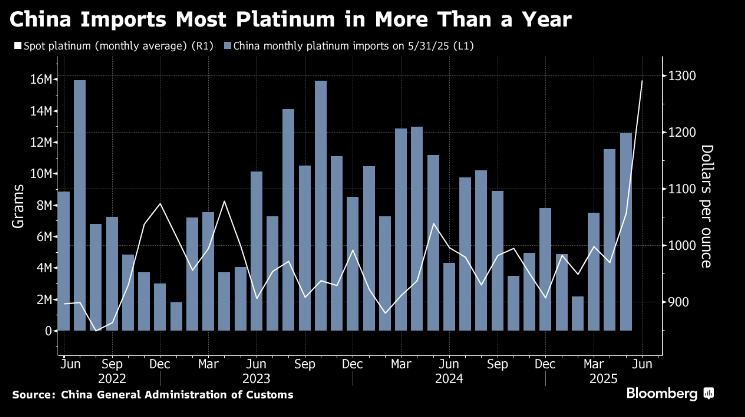

Platinum imports by China surged to the highest level in more than a year, adding to signs of solid demand as prices surge, according to Bloomberg today, joining a chorus of coverage in the last four weeks keeping tabs on an accelerating drop in inventories.

In oil and geopolitics, Trump casually sliced the legs out from under the ‘regime changers’ yesterday with a two-week pause. Israel will keep pounding. The Strait of Hormuz will stay open for business.

In the markets

The dollar took a peek above the T line to see if anyone else was there, and so far, the sounds of fury are the chirping of crickets. However, it’s a long day. Wait at the bus stop for the bus.

Gold dropped into the middle-ish of this very broad and dense POC with the most actively traded price at $3345.00. However, the precise POC is moot because every price from $3410.00 down to $3330.00 is within a few TPOs of the same activity.

Gold is saying, “I am willing to do business with equal liquidity anywhere in this range.” In time, one of these prices will dominate, and it is from that that the most losers will locate their trades. When prices do finally move away from that yet unknown POC, it will be the losers who will create the imbalance driving it.

More on gold, silver and platinum up next, plus oil gushing literally out of Iran (check the link!), stocks looking to pin 6000, and the mopping up has already begun immho (I hope pray) … in the vibe.

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.