February 21…)

“The best time to plan a murder is while you are doing the dishes.” Agatha Christie

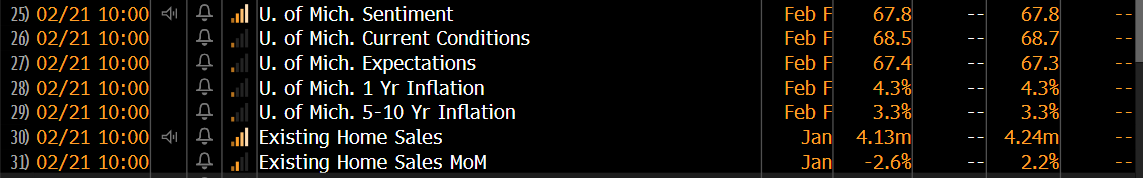

U Mich at 10:00

In the news

“Retail Demand is starting to fade, and it is time to pay taxes in March. Happy Trails.” Scott Rubner sees a correction in stocks (2/20/2020).

Trump and Bessent are contemplating duration swaps to lighten the 2025 refunding, a great idea, I think. Of course everyone heard Trump’s assurance a plan is in the works to verify the existence (or not) of our gold in Fort Knox. More on that in the vibe.

A lot of buzz about Dollar Yen and JGBs this morning. Ueda says he will intervene if rates rise sharply after yields hit 15 year highs in January. Wall Street is still talking about an OPEC production increase not happening as if it were the emperor’s new clothes. BBG says someone bought size in May Brent 100 calls yesterday. No comment about what they sold against them.

Newmont announced a record Q4 performance yesterday, including $5.65 billion in sales (beating estimates of $5.12 billion), adjusted EPS of $1.40 (versus $1.06 expected), and 1.9 million ounces of attributable gold production. The stock is down .09 cents in pre-market trading.

In the markets

About a million ounces of new longs and shorts have enetered the futures market since Tuesday’s settlement on declining volume and small ranges. There are no new narratives other than USD weaknes and the Yen pop.

March silver is moving horizontally in quite trading on steady and moderate volume and rising relatively high open interest of 171k lots. last year’s high in OI was 180 and the 2020 5 year high was 193k. The ATH was 236k in 2019.

As for the SLV expiry today you can mark $33.37 for March Comex with $29.99 for SLV now. However it is an arb with a lot of elasticity. If silver goes lower it’s a non event; just another day.

From a high level, these encircled rejections are a good example of the market’s upward pressure and the highlighted vertical bar last Friday a good example of the short’s power to force silver prices down. In the end the market will go where it has to go. Therefore whatever your opinion may be, patient and decisive preparation will afford you the opportunity to get low prices when the short is selling and sell good rallies when he stops, I think.

Moving along with oil, stocks, bitcoin and an assessment of the Trump plan to check out Fort Knox…. not quite what you might think!

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.