“The green movement is dying." Stuart Varney Fox Business News 1/28/2025

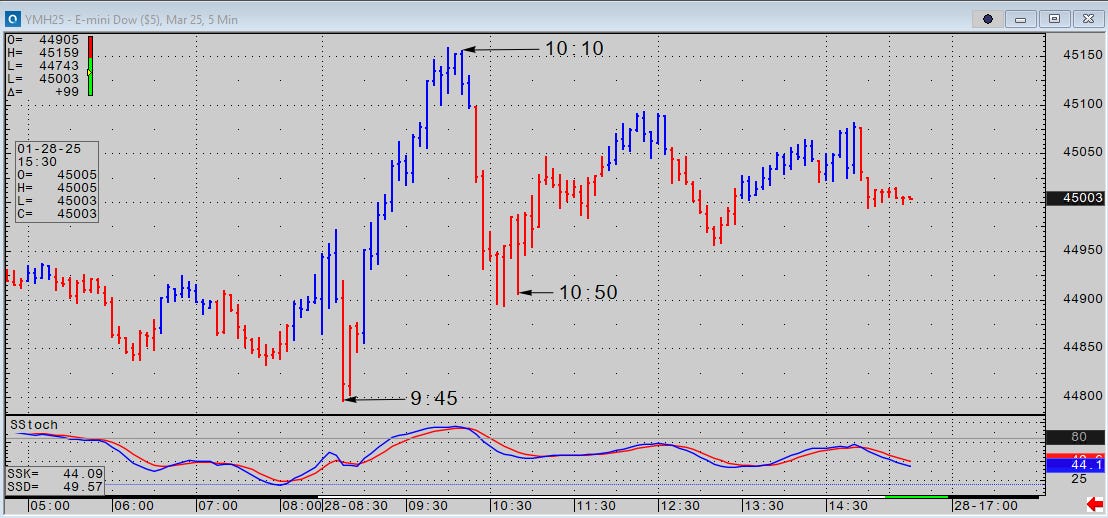

Activity on the stock exchanges was instructive today. Shortly after the opening, algos started buying the Dow, S&P, and NDX futures indexes, rallying each 1.5% in an hour. All three programs paused at 10:10 AM and recommenced at 10:50.

These were sophisticated algos (I have written algos, so I am speaking from experience) that never allowed prices to decline below a rising benchmark. These execution algos can see the book of liquidity and calculate order size to both match and marginally exceed present liquidity, including any incoming orders, regardless of size, and adjust order entry accordingly. The objective is not to get the best price. It is to raise the price without allowing sellers the benefit of responsive selling into a price void. And there are algos out there written to do exactly that. Remember, we are in the age of AI.

S&P emini 5 minute data

NDX emini 5 minute data

The Dow e-mini 5-minute data: As you can see, when the program stopped buying at 10:10, Dow e-minis tumbled immediately. A new program restarted at 10:50.

Volume profiles and entry times are identical. What this means to me is two things:

Someone or a group wanted stocks higher today. Pick a name or a sector with common interests.

More importantly, the stock market has effectively become a single asset, like gold or oil. It is a mass of molecular-like parts, but its price is actually one price. Notwithstanding rotations, flows into it often appear to be contrived for cosmetic effect.

It doesn’t happen every day, but during unexpected events like the Yen Carry meltdown in August, any amount of resources necessary can be called on without limit to protect it. If today wasn’t unnecessary overkill (I think it was), that’s a big problem.

Good trading allows markets to breathe naturally. Even the BOJ respects a breath between interventions. Hyper-leverage cannot tolerate even the tiniest whiff of lower prices. For instance, August 5 was a full-blown crisis. When “run hot” was ending in late 2021, Powell started warning Wall Street more than a year before the first hike. No doubt, phone calls were made. Even so, we had a banking crisis in March 2023.

Yesterday’s decline in Nvidia was a random event that was probably discussed offline. A strategy was agreed upon to repair it, including appropriate news items, and the result of that agreement was present in these syncopated pulses of bespoke orders managed by algorithms today. If this were organic and responsive activity, it wouldn’t look like football practice with a coach tweeting his whistle.

In other markets

Gold rose 1.2%, and silver rallied 1.5%. Copper was a little higher. Trump’s specific inclusion of copper in tariffs is a specific tariff on China, the owner of the LME and the largest stock of marginal supply. Last May, COMEX May copper suffered a severe squeeze, and Trump is going to reply by making Chinese copper punitive to buy in America. We can get plenty in Latin America or buy it from exempted third parties.

More commentary on stocks today in the vibe… and an extensive review of relative value charts, including gold, copper, oil, bitcoin, silver, and stocks ahead. Stay tuned:

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.