December 19… 8:41 EDT )

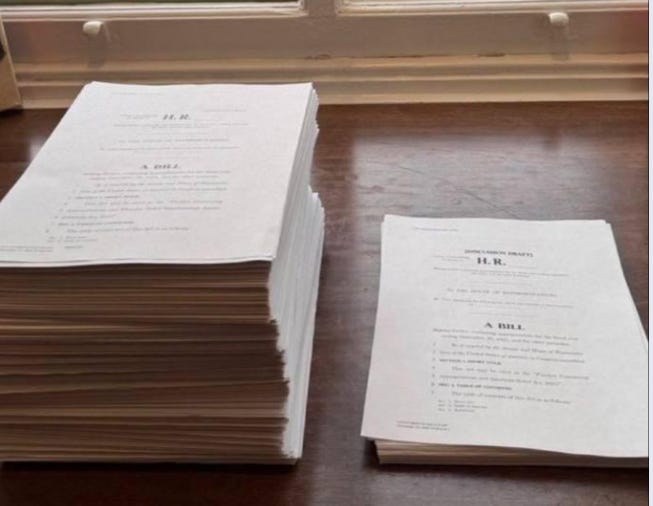

“We need real government shutdowns to get spending under control.” Elon Musk. The latest plan to avert a government shutdown went down in flames a few minutes ago.

December 19…

In the markets today…

Usually a market that clings to its lows implies unfilled selling above the markets. So, let’s begin with the relic. There was significant selling of gold on November 6 when Trump was elected, and again last week when gold EFPs were forcibly liquidated.

On November 14 responsive buying halted a $250 sell-off at $2565.00 (noted on the chart). Prices rallied and re-estalished a range ca $2660 for a month. That range was conclusively distribution of risk. Now, there appears to be a long-time frame buyer of February gold at $2600. It may be the same buyer that entered the market on November 14.

However, I think, the weight of selling across the board will outweigh the bid, especially if trends in USD, stocks, and bonds extend their ranges tomorrow. Every long entry since September 13 is losing money as of the close this evening.

Although more length entered S&P futures yesterday (new high in OI), there were no dominant buyers today. Tomorrow is a quadruple witching, which usually means extremely small ranges as option grantors try to depress premiums to zero. I don’t know where the gamma is, but my gut tells me the weak side is still beneath us.

Ninety-five percent of all longs that entered the S&P since the election are losing money at settlement tonight (rectangle with voids up and down). Tonight’s close is the bottom of the post-election range, so length is not stressed with losses yet. However, it takes a tremendous amount of money and mental energy to sustain (big) losing positions over time if a trend develops, and there is a notable amount of length already in debit.

Next up: Bitcoin shows a technical red flag, MSTR is diverging lower, Nat Gas hits the range top in another strong day( very well worth looking into), and USD trades at another multi-year high.

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.