December 26 … )

“God bless us, everyone.” Tiny Tim

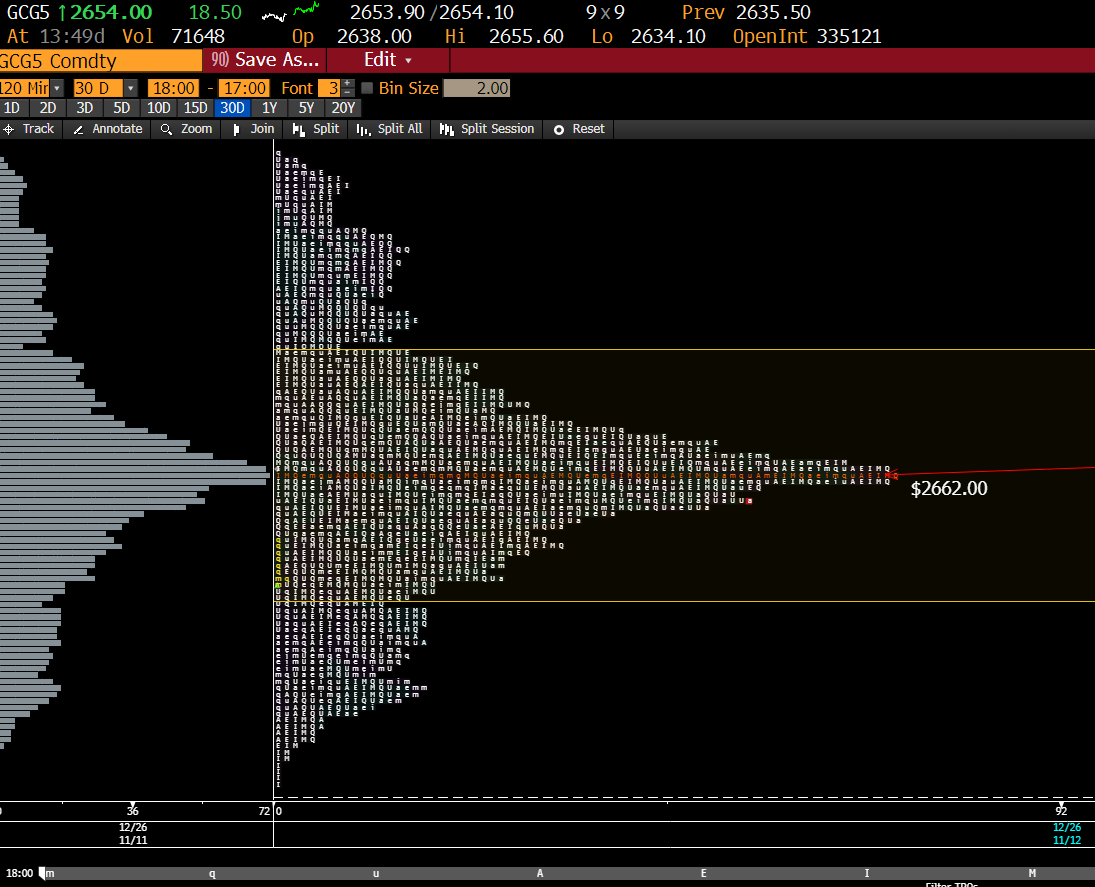

This is a 30-day compression profile of gold, with prices ranging from $2,770 to $2,566 during the period from 11/11 to 12/26. I had to abbreviate it because the full chart would have been illegible on the Substack platform. But detail doesn’t matter. I wanted to show the reader a perfectly balanced auction with a perfectly formed point of control (the most actively traded price) at $2,662.00 in this 30-day sample.

February gold has actually been trading at or around $2,662 since October. So, what does that tell us, other than $2,660 being where the highest number of trade opportunities have occurred? This is the price from which, when the market finally moves away, the largest number of losing trades will have been located.

And… $2,662 will be a number to remember in January, especially if a high-volume move stops at $2,662 or originates from it. Until then, I think it’s safe to say February gold will trade there and return repeatedly until the New Year gets underway next week.

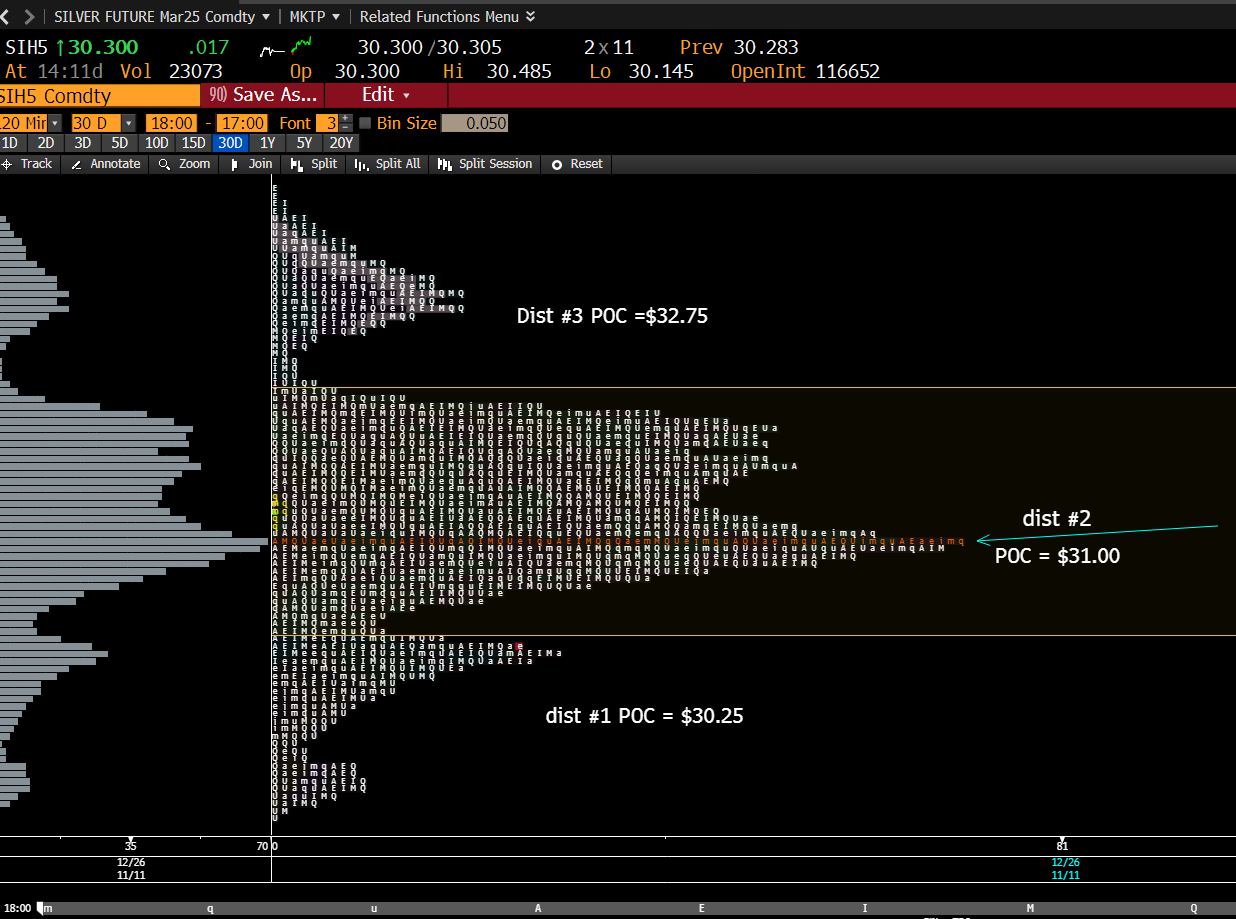

This is silver. The same data sample, but instead of a single well-balanced profile, silver has three distributions with two minor Points of Control and a major POC at $31.00. Actually, the high TPOs (time price opportunities or better said “prints”) range from $30.80 up to $31.80.

For now, silver is stuck in the lowest distribution. However, if gold trades above $2,660, silver will probably get pulled into the mid-$31.00s.

The silver bar chart looks like the ghost of gamma past. Ah, what might have been.

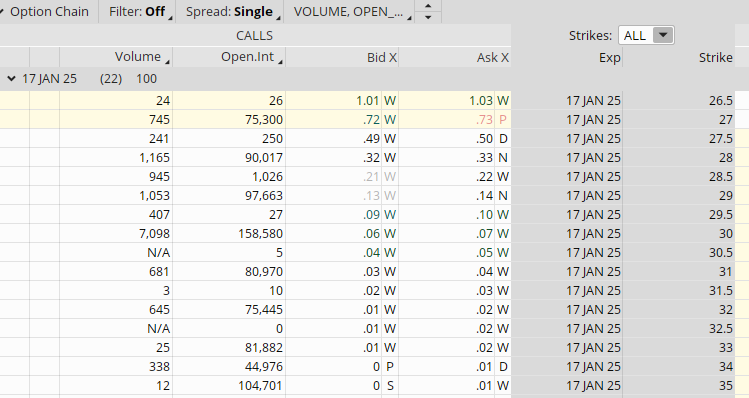

Millions of shares of SLV calls struck in October and November are now covered or marked close to zero for December 31 expiry. The Jan 17 calls are also marked at pennies, with ATMs at $27 and three plus weeks to expiry. Higher Jan 17 calls above $31 are effectively cabinet bid (posted below). Almost 17 days in January is a big chunk of time, but $31 SLV is a big move => $33.50 for march.

here’s the jan SLV slate: About 30,000,000 mm shares (ounces) are still outstanding between $28 and $30. SLV = $27 now. Good to know jic.

In other markets

Stocks are treading water. Sellers are out, and buyers are holding a full boat. I’ve been shorting February crude in very small positions above $70 with mixed success for a while. It always dips but always comes back, so I either scratch or make bupkas. I took another shot today just to have something on if it breaks. As I said this morning, there’s no technical evidence indicating a big move in oil is imminent—just my sniff.

Up next: Natural Gas and Bitcoin, with some vibes on rates stocks and January.

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.