June 4…)

“Following the light of the sun, we left the Old World.” Christopher Columbus

Mortgage applications at 7:00 AM EDT fell -3.9% affriming a growing glut of unsold houses, ADP at 8:15 AM EDT just tanked to 37k vs 114 expected and a 2 k downward revision last month…. ooof!

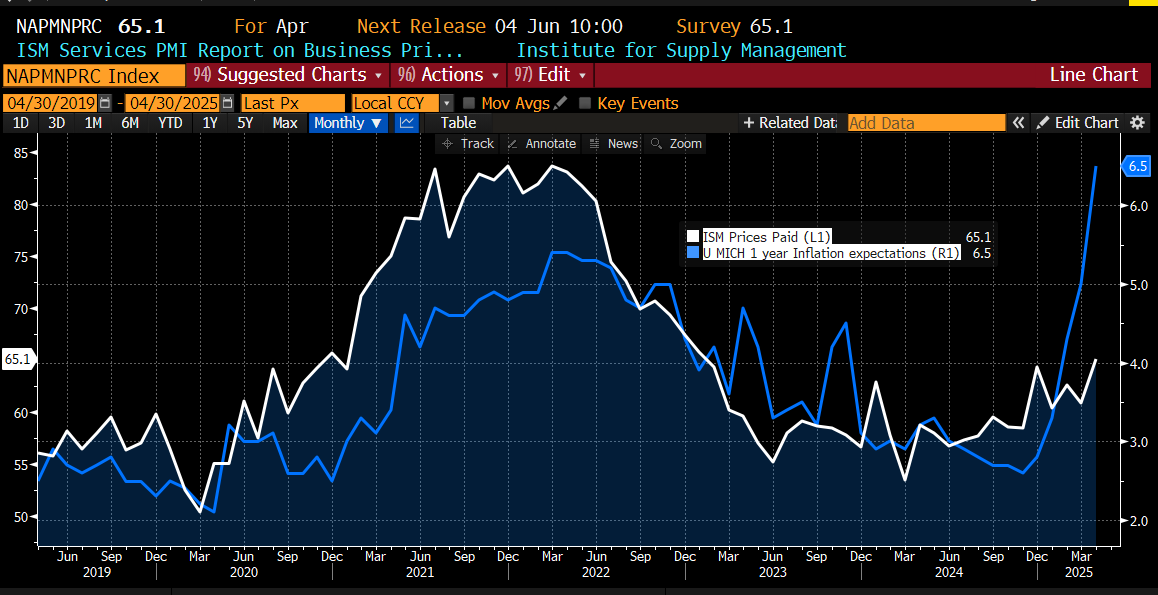

ISM prices paid at 10:00 has been aligned with last week’s U MICH 1 year inflation expectations although more subdued. No doubt the bond traders will be watching it.

In the news

Goldman said central banks are buying around 80 tons of gold per month. The purchases, which have been led by China, will probably continue, driving prices even higher. Most of the buying is secret, although trade data indicates most is going to China, along with other unidentified buyers via Switzerland.

Iran called American officials “arrogant” for expecting Iran to stop enriching uranium. Listening to the evening news last night, it seems there is a hawkish consensus for military action if the impasse is not resolved soon.

Iran’s oil exports to China were just over 1.1 million barrels a day in May, about a fifth lower than a year earlier, according to estimates by Vortexa via BBG. That is a function of demand, not supply.

The DOE reports petroleum inventories today at 10:30 AM EDT, all eyes on RBOB. The API said gasoline inventories rose 4.7 million barrels last week.

In the markets

S&Ps are clinging to their highs. Usually, a market that stays at the highs implies unfilled buyers below. There is a (red DMI) 1-bar false positive underpinning the range, and my slo-stoch is creeping higher (re: stoch discussion in the evening wrap last night).

OI rose to the highest in 3 weeks yesterday. Note: we have 30k lots of new length and new shorts. Go stocks! New highs will bring additions to that position. I think prices would have to close under 5850 to threaten it. I wonder what the short is thinking; the POC maybe?

The only missing piece to the puzzle for the bulls is very low volume. The machines won’t be active until the switches turn on at 9:30 unless there is a dovish surprise in ADP of such magnitude the get-go gets going early today.

Bonds, USD FX, bitcoin, and NYMEX oil futures are all little changed. Let’s have a quick look at the charts to see what exchange data from yesterday’s session can tell us.

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.