“We have it in our power to begin the world over again.” Thomas Paine, January 10, 1776

The supply of oil and demand for it is not the issue as prices seek balance in 2025. It is the capacity that so many possess to produce oil. That is the issue. It is easier and cheaper to find oil and fund its production than ever before. As for demand, it is harder to create real and growing demand than it has been in a very long time. Just ask China.

Stopping migration in America will lower consumption. Deporting people and reversing the flows of millions of migrants will accelerate that dynamic decline. Cutting federal spending will reduce consumption. Peace in Ukraine and the Middle East will reduce hundreds of billions of demand for military production and exports.

Even if China’s attempts to stimulate its economy do work, the global economy is not aligned. At best, demand grows regionally. The cascading wave of interest rate cuts in the West implies we are already in a selective recession. Clinging to the pretenses of control, like cutting rates and oil production, does not mean the Fed or OPEC is in control. Just look at the bond market.

The U.S. consumes more oil than anyone on Earth. However, demand for all products has not increased in 25 years (chart below).

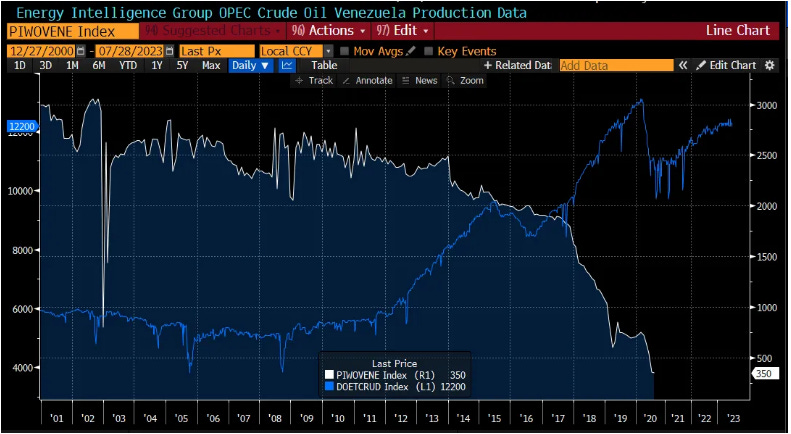

In the late ’90s, Venezuela produced nearly 3.8 mm bpd. In 2020, Venezuela’s production of barrels per day had fallen 90% to 350,000 (next chart). Today they produce ca 750k bpd. If Venezuela were to recover at scale, oil prices would collapse to single digits.

Venezuela produces low API crude, which is good for U.S. refiners blending high API domestic production, but there’s no room for Venezuela’s oil in the market because Canada and others are filling the need for it.

Generally speaking

Capacity is everywhere. KSA has millions of barrels of spare capacity. Canada is planning to increase bpd, exporting east with the Trans-Canada Pipeline. Trump wants to restart the third leg of the Keystone, shipping another 900k bpd south from Hardisty. Russia, Ukraine, Israel, and Turkey are awash in energy resources. There is an ocean of above-ground commercial and official oil in storage, >50 days of global supply.

The global petroleum industry and the world, for that matter, prefer stable prices to volatile price spikes, so much so that price ranges have tended to endure well beyond their economic justification for years. A discussion of that idea is next, and why lower prices imply the stability everyone wants (except OPEC).

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.