February 10…)

“It's been a long time comin'

It's goin' to be a long time gone.” David Crosby

In the News

No data this morning. CPI on Wednesday is expected to be generally lower among mixed forecasts and surveys.

The Eagles are an NFC team, and according to the Super Bowl indicator, from 1967 to 2025, whenever an NFC team wins, the S&P 500 has had a positive year 68% of the time. However, Kansas is an AFC team, and they won last year, and the S&P went up anyway. Still, greater than one in three are tradable odds in a 59-year sample.

Both Tass and the White House are coy about rumors that Trump may have called Putin.

A Chinese pilot program will allow 10 insurance firms to invest up to 1% of their assets in gold, potentially freeing up $27 billion of funds, adding further impetus to a record-setting rally. The price surge is leaving buyers in China behind (published on Friday).

Trump ordered the Treasury to stop minting pennies. DOGE said each one-cent coin costs more than 3 cents to make, costing U.S. taxpayers over $179 million in 2023 (BBG). In 1982, the Mint stopped making copper pennies (95% copper) because people were hoarding them and switched to 97% zinc. In 1990, Jim Kolbe of AZ proposed legislation to do away with the penny altogether, but it never made it to the floor. Since then, Obama suggested a ceramic penny, but that died on the drawing board. As the penny is laid to rest, the dollar has taken its place, having lost roughly 99% of its purchasing power since the inception of the Federal Reserve, whose primary mandate was a stable currency.

In the Markets

In gold, the declarative trend continues to speak softly as prices auction weightlessly higher. Volumes are steady and unfrothy, the trend is orderly but relentless. The general consensus is the “bar shortage” is temporary, but buyers are not willing to take the risk of being alienated from their metal as prices keep going higher. This entire rally has been founded on the willingness of institutions to lose scary amounts of money to clear their risk to gold. That risk has been passed around like a hot potato for nearly three months, and judging from the price, it’s still not yet closed!

I noted OI falling and rising. What I mean is Feb deliveries are offsetting OI, but new length in April is more than replacing it. On Jan 23, a week before first notice day, February OI was around 270k lots. That number has fallen 262k lots, but aggregate OI is only down 65k lots. In my opinion, although the OI implies the market is liquidating shorts, it’s still growing. OI is about where it was on Jan 13 when the “squeeze narratives” started gaining serious traction.

Here’s good summary of the narratives swiring on social media I found on Telegram this weekend.

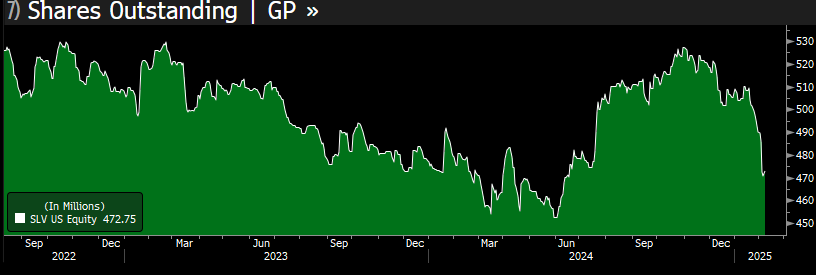

Silver is typically enigmatic or schizophrenic this morning; record-high borrowing costs to short SLV shares and SLV shares outstanding have collapsed! No wonder prices are soft…

On Friday, silver fell a dollar as gold finished up $10.

This next LBMA chart has been going around for a while (source: Bonner Research), but silver is almost impervious to the strength in gold due to similar market forces. The word "almost" is used as loosely as the word "enigmatic."

It is no secret that new mine production is at a four- or five-year low, and commercial usage is similarly high. What seems to be offsetting these fundamentals is the disintermediate decline in ETF holdings (1st chart above) and an obvious flood of short selling paper silver and options and borrowed shares.

In my opinion…The rub is, that a buyer has to absorb millions of shares (ounces) from and the short can sell millions more deep in-the-money calls and put zero pressure on T2 spot. In short (lol, good word), SLV has become a paper silver factory that can depress prices temporarily and vanish at expiration to be sold again and again… In my opinion.

next up, oil, stocks, bitcon bonds and a few words about the systemic risks implied by the ongoing saga of dislocation in gold:

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.