September 23…)

“Of course, some people do go both ways.” The Scarecrow, The Wizard of Oz

So begins the last week of the last month of the third quarter of 2024. Many all-time highs are behind us. The Fed has finally turned the page. The markets got more than they asked for but it’s never enough. Which might be a good thing. The only time the market is happy is when it’s wrong.

The most insightful comment I read this weekend was a question asked by a sage GS executive. “[there were five times] over the past forty years when the Fed eased and a recession didn’t imminently follow. On average, the S&P rallied 17% in the 12 months after the first cut so,” he said, “do you expect a recession or not?”

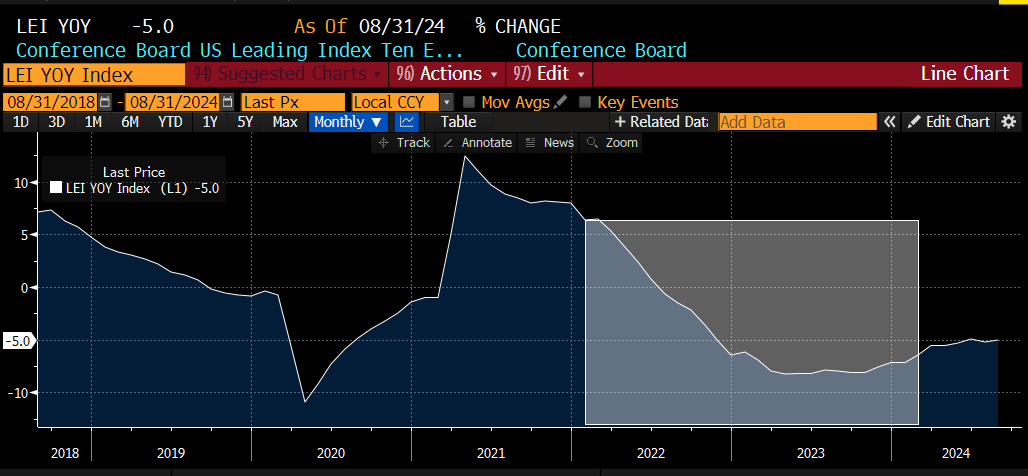

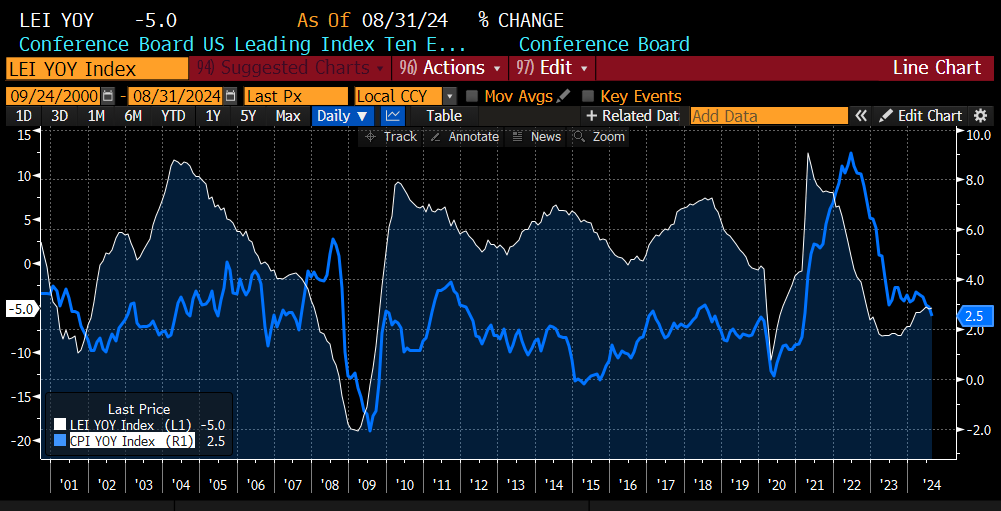

However, in making the call, there are differences that skew comps between now and the past 40 years. Some say we have been in a recession for more than a year and it is getting worse. The Fed says we have yet to fall into one. The conference Board LEI confirmed a recession was imminent in January 2022, and according to its 3 months consecutive trend rule, we just emerged from it in May or June 2024.

The index has been a reliable indicator since the 1930s but analysts say its days of use are past because .. “times have changed”. Click the link and scroll down to the components they measure…You decide.

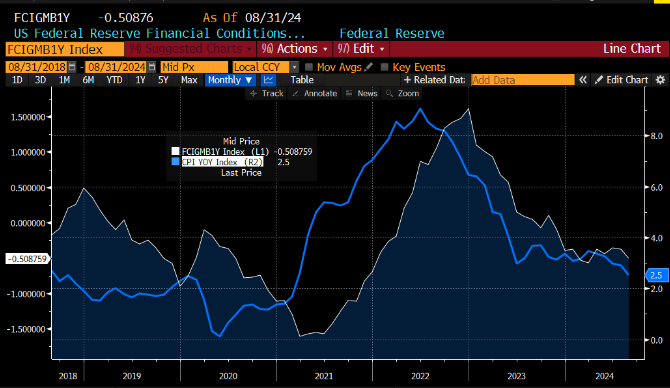

Here is the Federal Reserve’s Financial conditions index as of August 31 with CPI overlaid. CPI peaked in June of 2022. Financial conditions peaked in December of 2022. Despite their lags, or perhaps because of them, these indicators behave identically, a rarity.

The only other time CPI and Fed financial conditions were positively correlated with similar lags was from 2008 to 2011.

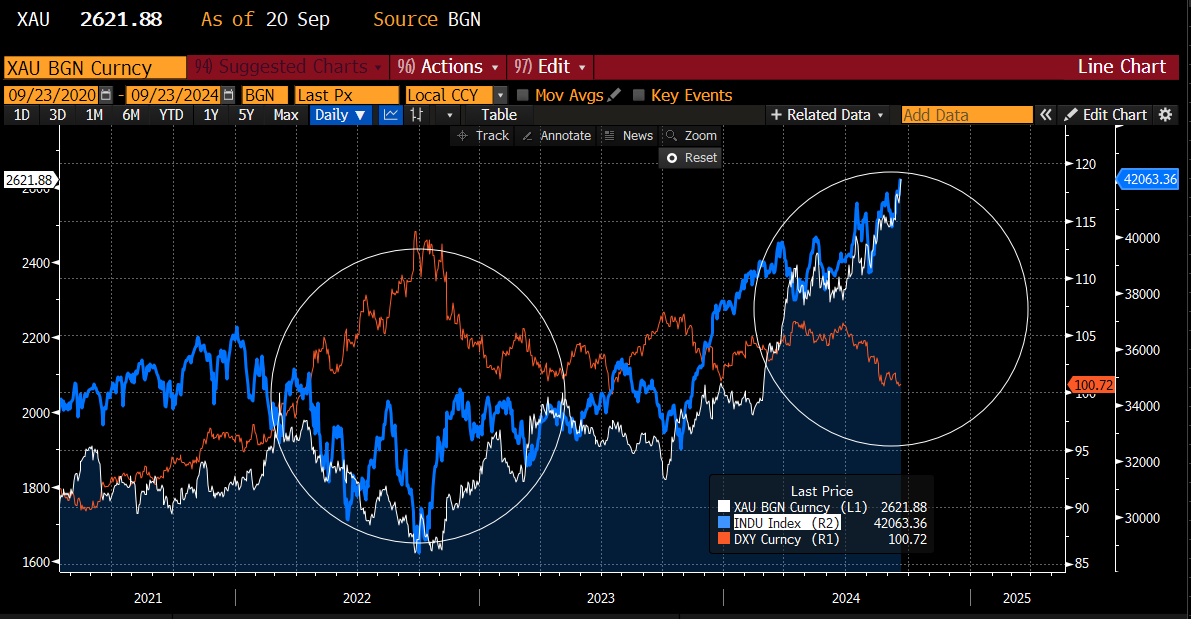

Gold and equities are an exquisitely correlated pair in the next chart. Both are negatively correlated to DXY. The narrative is powerful; trillions of fiat money rising exponentially ad infinitum.

This is the footprint of covid liquidity in the years 2020 to 2022 when the Fed began hiking … stopped hiking in July 2023 … and the ferocious surge in gold and equities as various inflation data declined. The cuts have yet to kick in.

I wonder. Are we asking the right questions? Let’s find out.

Keep reading with a 7-day free trial

Subscribe to market vibes to keep reading this post and get 7 days of free access to the full post archives.