October 29… )

“If I had more time, I would have written a shorter letter.” Twain

I started the day waxing lyrically about bitcoin finally making its fated ascent to $100k. OI rose modestly yesterday, and I’d be surprised it didn’t leap higher today when we see the data tomorrow. Volume was light but buying pressure is increasing and buyers are aggressive. This is not fomo, but I can see its shadow around the corner. Today’s close is the highest since mid-June.

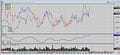

The NDX rose with authority led by the Mags with modest technical development, low voume and a vertical rally in the day structure. if I were short I would have been flat by the bell.

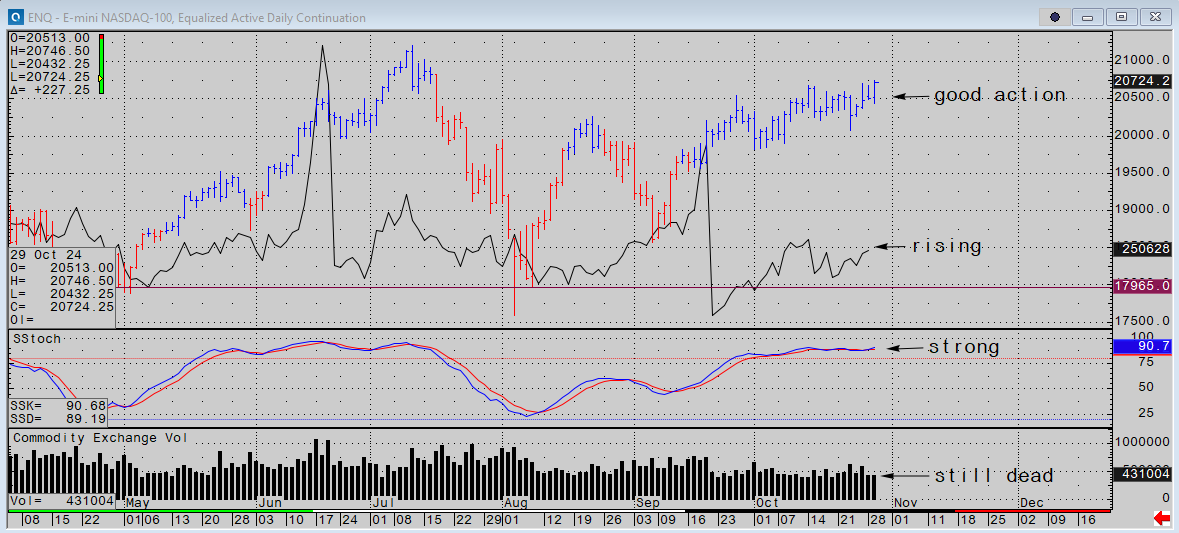

The S &P observed in silence and a slight upside bias following big caps in NDX.

In other markets,

Bonds prices were slightly higher, and dollars were slightly weaker but the larger trends in both interest rates and FX remain solidly in force.

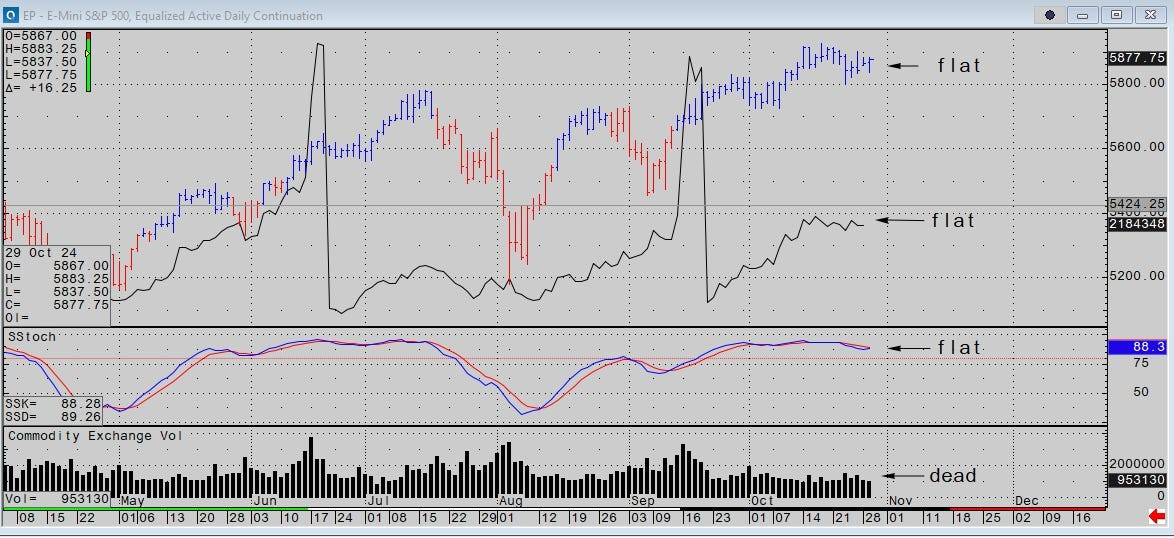

in Oil, prices did not sustain an early bid and faded to a new low exceeding yesterday’s low. In the pits we used to say, “Dimes count” at settlement. I would give the session to the sellers with a golf clap. The Israeli weakness narrative is still weighing on sentiment. Spreads did nothing and cracks were mixed.

For the first time in quite a while I think crude is going to take the lead up or down, not products…but probably down. Which would be good for margins.

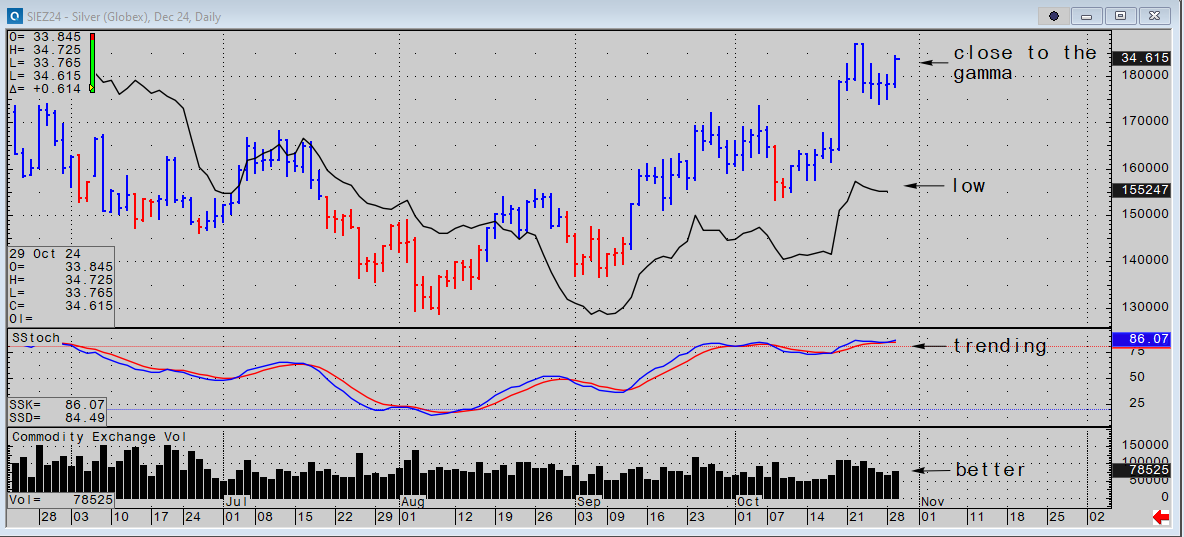

Silver had a better day than I expected because gold had a great day. These prices are close to the lower edge of the red zone.

Gold prices came strong and stayed bid at the highs all day. A market that clings to its highs implies unfilled buyers below.

My vibe

I said this morning after posting betting odds on a Trump victory that markets will trade today the way they will trade if he wins. Money doesn’t need a flashlight at high noon. It knows where it wants to go.

Big cap tech and the mags did well all day. Bitcoin did well all day. Gold (and silver) did well all day. Copper fizzled.

Bonds and dollars traded indecisively. They may revert or resume their primary trends, but they are on watch. The rest of the board seems to be doing some early voting.

…if you’ve ever done taping you’ll know how good this guy is!

Good luck in Asia!

JJ

Please feel free to share selectively with friends and colleagues. Thanks a million for your likes!!

Follow me on X @Alyosha745

Charts and data CQG and Bloomberg

Market vibes is not a registered investment advisor, and comments are for informational use only. Any mention of a particular security, index, derivative, or other instrument is NOT a recommendation to buy, sell, or hold that security, index, derivative, or any other instrument. Market vibes makes no representations as to the accuracy of data or any attributions.

21% corporate tax rates are a big deal. 15% are a bigger deal.

Love the taping video! 👌